Your Annuity Business Plan: How Dreams Become Reality

Anthony Owen | August 3rd, 2011 | Business Plan,

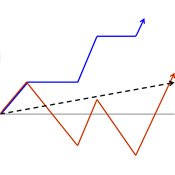

Have you ever heard that most people spend more time planning a vacation than their retirement?I have a new one. Most annuity agents are not business owners and they spend more time planning a vacation than developing a marketing plan and setting goals.Our partners hopefully don’t reflect that statement and I know for sure most of you don’t. Here is an email I got from one of our partners today. What you see in this email is how dreams become reality.